Use a day counting table to determine the due date of the loan if the loan is made on the given date for the given number of days.March 25 for 60 days

A. May 19

B. May 24

C. March 1

D. June 9

Answer: B

You might also like to view...

Find the flux of the vector field F across the surface S in the indicated direction.F(x, y, z) = 6xi + 6yj + 6zk , S is the surface of the sphere x2 + y2 + z2 = 1 in the first octant, direction away from the origin

A.  ?

?

B. 2?

C. 3?

D. 0

Solve the problem. Express answers as a percent rounded to the nearest tenth.

Complete a vertical analysis on the balance sheet for Jake's Janitorial Service for December 31 of last year. The company assets are cash  accounts receivable

accounts receivable  merchandise inventory

merchandise inventory  and equipment

and equipment  The liabilities are accounts payable

The liabilities are accounts payable  wages payable

wages payable  and mortgage note payable

and mortgage note payable  The owner's capital is

The owner's capital is

A. Jake's Janitorial Service Balance Sheet

Cash: 13.6%

Accounts receivable: 23.5%

Merchandise inventory: 37.6%

Equipment: 25.3%

Total assets: 100%

Accounts payable: 14.4%

Wages payable: 24.7%

Mortgage note payable: 26.7%

Total liabilities: 43.9%

Jake's capital: 56.1%

Total liabilities and owner's equity: 100%

B. Jake's Janitorial Service Balance Sheet

Cash: 13.6%

Accounts receivable: 23.5%

Merchandise inventory: 37.6%

Equipment: 25.3%

Total assets: 100%

Accounts payable: 6.3%

Wages payable: 10.9%

Mortgage note payable: 60.8%

Total liabilities: 43.9%

Jake's capital: 56.1%

Total liabilities and owner's equity: 100%

C. Jake's Janitorial Service Balance Sheet

Cash: 13.6%

Accounts receivable: 23.5%

Merchandise inventory: 37.6%

Equipment: 25.3%

Total assets: 100%

Accounts payable: 6.3%

Wages payable: 10.9%

Mortgage note payable: 26.7%

Total liabilities: 43.9%

Jake's capital: 56.1%

Total liabilities and owner's equity: 100%

D. Jake's Janitorial Service Balance Sheet

Cash: 13.6%

Accounts receivable: 23.5%

Merchandise inventory: 37.6%

Equipment: 25.3%

Total assets: 100%

Accounts payable: 14.4%

Wages payable: 24.7%

Mortgage note payable: 60.8%

Total liabilities: 100%

Jake's capital: 56.1%

Total liabilities and owner's equity: 100%

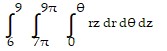

Evaluate the integral.

A.  ?3

?3

B. 9264?3

C. 4053?3

D.  ?3

?3

Multiply.

A.  x2 -

x2 -  x +

x +

B.  x2 -

x2 -  x +

x +

C.  x2 +

x2 +

D.  x2 +

x2 +  x -

x -