Discuss the differences between a will and a trust

A will is an instrument which helps a person direct her assets to the desired beneficiaries after death. It generally can be revoked or altered at any time prior to death. Without a will, the decedent's property will be distributed according to the intestacy statute of the state where the decedent resided at the time of death. The reasons to have a will include: to distribute assets according to your wishes; to select a personal representative to oversee the estate; to avoid legal issues and expenses that are more likely to arise if there is no will; and to name a guardian for minor children.

A trust is an entity that separates legal and beneficial ownership. The trustee becomes the legal owner of the trust assets, but must use them for the benefit of the beneficiary, who has equitable title. There are three entities involved in a trust: the settlor, the trustee, and the beneficiary. Trusts may be created while the settlor is alive or through a will. The advantages of a trust include: the settlor can leave instructions for the control of the trust assets after death; a trust can be set up to manage property that will ultimately go to individuals who are currently minors; a trust can save taxes; and the assets of a trust are not probated.

You might also like to view...

The model that requires a manager to assess her own style and her situational control is

A. Fiedler's contingency model. B. shared leadership model. C. the LMX model of leadership. D. House's path-goal theory. E. charismatic leadership theory.

Performance reports are often part of a managerial reporting system known as a responsibility accounting/reporting system

Indicate whether the statement is true or false

A business plan that provides information to potential licensees is referred to as a(n) ________ plan.

A. screening B. concept C. invention D. operational

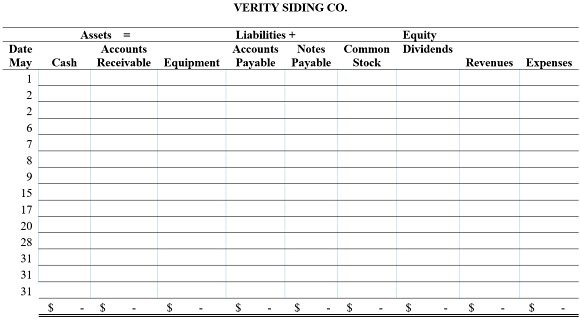

Verity Siding Company, owned by S. Verity, its sole stockholder, began operations in May and completed the following transactions during that first month of operations. Show the effects of the transactions on the accounts of the accounting equation by recording increases and decreases in the appropriate columns in the table below. Do not determine new account balances after each transaction. Determine the final total for each account and verify that the equation is in balance.May 1S. Verity invested $90,000 cash in the company in exchange for common stock.?2The company purchased $25,000 in office equipment. It paid $10,000 in cash and signed a note payable promising to pay the $15,000 over the next three years.?2The company rented office space and paid $3,000 for the May rent.?6The

company installed new vinyl siding for a customer and immediately collected $5,000.?7The company paid a supplier $2,000 for siding materials used on the May 6 job.?8The company purchased a $2,500 copy machine for office use on credit.?9The company completed work for additional customers on credit in the amount of $16,000.?15The company paid its employees' salaries $2,300 for the first half of the month.?17The company installed new siding for a customer and immediately collected $2,400.?20The company received $10,000 in payments from the customers billed on May 9.?28The company paid $1,500 on the copy machine purchased on May 8. It will pay the remaining balance in June.?31The company paid its employees' salaries $2,400 for the second half of the month.?31The company paid a supplier $5,300 for siding materials used on the remaining jobs completed during May.?31The company paid $450 for this month's utility bill.

What will be an ideal response?