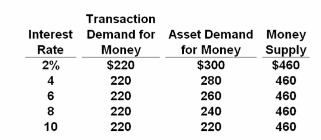

Refer to the given table. An increase in the money supply of $20 billion will cause the equilibrium interest rate to:

Answer the question on the basis of the following table:

A. fall by 4 percentage points.

B. fall by 2 percentage points.

C. rise by 4 percentage points.

D. rise by 2 percentage points.

B. fall by 2 percentage points.

You might also like to view...

The prisoner's dilemma illustrates

A) how oligopolists engage in implicit collusion under strategic situations. B) how cooperation in strategic situations leads to the economically efficient market outcome. C) why firms will not cooperate if they behave strategically. D) why firms have an incentive to cheat on agreements.

When no property rights exist

A) no one has an economic incentive to care for common property, and an externality may well occur. B) there will be no production. C) externalities will be internalized by voluntary arrangements among a small group of parties. D) society will produce beyond the production possibilities frontier, but the allocation of resources is not apt to be optimal.

When the price of hot dogs at the supermarket increases, the quantity demanded of hot dog buns declines. This situation describes:

a. the income elasticity of demand for hot dogs. b. the income elasticity of demand for hot dog buns. c. the price elasticity of supply for hot dogs. d. the negative cross-price elasticity of demand for hot dogs and hot dog buns. e. the positive cross-price elasticity of supply for hot dogs and hot dog buns.

If the interest rate on the loanable funds market is above its equilibrium level,

a. the equilibrium rate will rise b. people will want to borrow more funds than are available c. the supply curve of loanable funds will shift to the left d. there is an excess supply of loanable funds e. this is an excess demand for loanable funds