Despite the cut in taxes during the 1980s, federal receipts rose all but one year during that decade.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Which of the following are the rules for finding the point of allocative efficiency?

A) Produce on the PPF and then produce where the marginal benefit and marginal cost are as large as possible. B) Produce on the PPF and then produce where marginal benefit equals marginal cost. C) Produce on the PPF and then produce where marginal benefit and marginal cost are constant. D) Produce on the PPF and then produce where the marginal benefit exceeds marginal cost by as much as possible. E) Produce anywhere on the PPF.

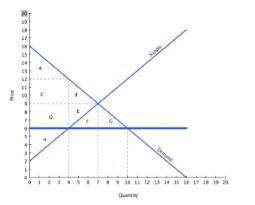

With reference to the graph above, if the intended aim of the price ceiling set at $6 was a net increase in the well-being of consumers, then positive analysis would consider:

A. whether the surplus transferred from consumers to producers is larger than the consumer surplus lost to deadweight loss.

B. whether the producer surplus lost to deadweight loss is larger than the producer surplus gained from a higher price.

C. whether the surplus transferred from producers to consumers is larger than the consumer surplus lost to deadweight loss.

D. whether the producer surplus lost due to lower prices is larger than the producer surplus lost due to fewer transactions taking place.

If China's real GDP grew from $7 trillion one year to $8 trillion the next, the annual growth rate would be:

A. 14.3 % B. 87.5 % C. 114 % D. 12.5 %

Complete the following statement. A collectively financed medical care system, providing universal coverage to a basic benefits package for everyone that includes the ability to purchase additional coverage with a supplemental insurance policy _____.

a. will do harm to the more vulnerable segments of the population - poor, sick, and elderly b. may not be equal, but is welfare enhancing for everyone c. seldom works when actually applied in the real world d. is unfair because it creates a two-tiered system