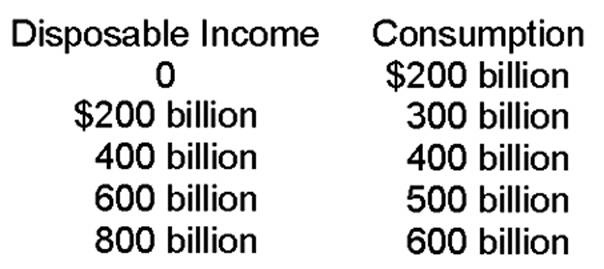

How much is the average propensity to consume when disposable income is $800 billion?

A. 0

B. .25

C. .5

D. .75

D. .75

You might also like to view...

There is a strong link between changes in the money supply and inflation

A) in neither the short run nor the long run. B) in the short run, but not in the long run. C) in the long run, but not in the short run. D) in both the short run and the long run.

People react to an excess supply of money by:

a. buying bonds, thus driving down the interest rate. b. selling bonds, thus driving down the interest rate. c. selling bonds, thus driving up the interest rate. d. buying bonds, thus driving up the interest rate.

During recessionary periods

A. tax revenues fall proportionately faster than does national income. B. budgetary surpluses are generated. C. decreases in nominal income are accelerated as tax revenue decreases. D. higher tax revenues are generated by progressive income taxes. E. the Congress must lower taxes if full employment is to be achieved.

Wage and price stickiness causes

A. changes in aggregate demand to have short-run effects on real Gross Domestic Product (GDP). B. changes in aggregate demand to have no short-run effects on real Gross Domestic Product (GDP). C. changes in aggregate demand to have long-run effects on real Gross Domestic Product (GDP). D. changes in aggregate demand to have both short-run and long-run effects on real Gross Domestic Product (GDP).