How much do you believe that current tax policy is influenced by politics, as opposed to sound and efficient tax policy?

What will be an ideal response?

This is a personal question but, in general, the United State' system of taxation has been

found to be very efficient. It is not perfect, and it is easy to find areas for improvement, but

given the number of people that are involved, it has worked remarkably well.

You might also like to view...

The income effect explains why there is an inverse relationship between the price of a product and the quantity of the product demanded

Indicate whether the statement is true or false

Which is the best example of a firm's implicit costs?

A) wages B) the opportunity cost of owner-provided labor C) rent D) taxes

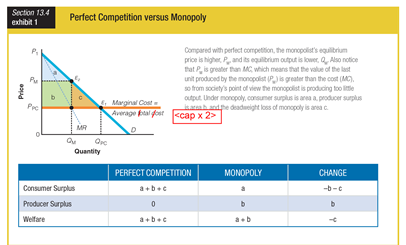

Based on the graphic for perfect competition versus monopoly, the change between the welfare of perfect competition and the welfare of a monopoly is ______.

a. a

b. b

c. -c

d. -a

If the absolute price elasticity of demand for a product is equal to 1, then

A. the absolute price elasticity of demand is unit-elastic and the percentage change in quantity demanded equals the percentage change in price. B. the absolute price elasticity of demand is inelastic and consumers are relatively sensitive to price changes. C. the absolute price elasticity of demand is elastic and consumers are relatively insensitive to price changes. D. the absolute price elasticity of demand is inelastic and consumers are relatively insensitive to price changes.