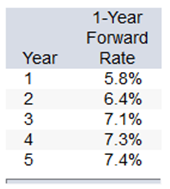

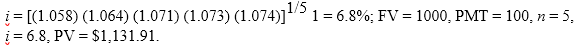

Calculate the price at the beginning of year 1 of a 10% annual coupon bond with face value $1,000 and 5 years to maturity.

A. $1,105

B. $1,132

C. $1,179

D. $1,150

E. $1,119

B. $1,132

You might also like to view...

Prospective adjustments are expected to

A) impact financial statements of only previous years. B) impact financial statements of previous years and current years as if the accounting principle had always been used. C) produce no impact on the financial statements of previous years. D) impact the financial statements of the current year only.

The auditor performs substantive procedures related to property, plant and equipment to determine if the assets have been pledged as collateral or title has transferred. What is the primary assertion the auditor is testing?

a. Valuation. b. Rights. c. Completeness. d. Existence.

If a portfolio manager had to estimate the fair value of investments in timber, which of the following would he/she most likely identify as the level of inputs to determine this?

a. Level 1. b. Levels 1 and 2. c. Levels 2 or 3. d. All levels would be applicable.

Pralow, Inc, leased an asset to Bender Corporation. The cost of the asset to Pralow was $8,000 . Terms of the lease specify four-year life for the lease, an annual interest rate of 1 . percent, and four year-end rental payments. The lease qualifies as a capital lease and is classified as a direct-financing lease. The asset reverts to Pralow after the fourth year, when its residual value is

estimated to be $1,000 . The amount of each rental payment is a. $2,000. b. $2,335. c. $2,501. d. $2,602.