Leonard, a company that manufactures explosion-proof motors, is considering two alternatives for expanding its international export capacity. Option 1 requires equipment purchases of $900,000 now and $560,000 two years from now, with annual M&O costs of $79,000 in years 1 through 10. Option 2 involves subcontracting some of the production at costs of $280,000 per year beginning now through the end of year 10. Neither option will have a significant salvage value. Use a present worth analysis to determine which option is more attractive at the company’s MARR of 20% per year.

What will be an ideal response?

PW1 = -900,000 – 560,000(P/F,20%,2) – 79,000(P/A,20%,10)

= -900,000 – 560,000(0.6944) – 79,000(4.1925)

= $-1,620,072

PW2 = -280,000 – 280,000(P/A,20%,10)

= -280,000 – 280,000(4.1925)

= $-1,453,900

Select option 2 - subcontracting

You might also like to view...

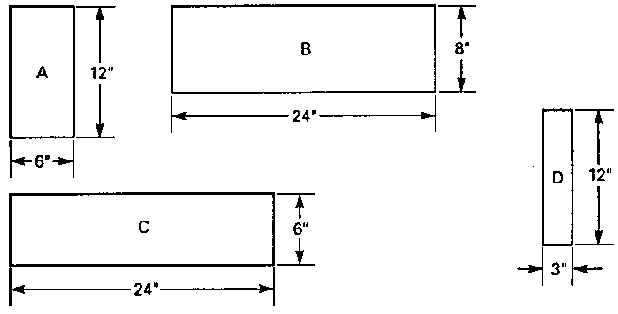

Calculate the area of plate C, in inches.

Potassium is taken up by the plant as K2O

Indicate whether the statement is true or false

Gilts need a lower concentration of dietary amino acids than do barrows to maximize lean growth

rates.

Indicate whether the statement is true or false.How does the refrigeration oil return from the chiller to the compressor?

A) Through an oil return system B) The oil return pump moves the oil from the chiller to the compressor. C) The oil stays in the compressor, eliminating the need for returning it. D) It is carried back by the refrigerant.