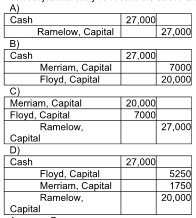

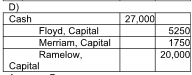

They agreed to admit Ramelow into the business for a one-fifth interest in the new partnership. Ramelow contributes $27,000 cash in exchange for the partnership interest. Assume that Floyd and Merriam shared profits and losses in a 3:1 ratio before the admission of Ramelow. Which of the following is the correct journal entry to record the above admission?

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:

![]()

Explanation: Existing capital $73,000

Contribution of new partner 27,000

Capital after admission 100,000

Capital of new partner ($100,000 × 1 / 5) 20,000

Bonus to existing partners ($27,000 - $20,000) $7000

Ramelow had to buy into the partnership at a contribution of $27,000, which is above the $20,000 book

value of his one-fifth interest. Ramelow's higher-than-book-value contribution creates a bonus for Floyd

and Merriam, which is shared between them in their profit sharing ratio, which is 3:1.

You might also like to view...

In the budgeting process, business, team, and individual goals are established. Human behavior problems can arise in all of the following cases except ________

a. the budget goals of the business conflict with the objectives of employees (goal conflict) b. the budget goal is very easy to achieve (too loose) c. the budget goal is void of direction that includes responsibility centers d. the budget goal is unachievable (too tight)

Why would an expatriate manager be better in one situation but a host-country manager better in another?

What will be an ideal response?

The rule which permits the jury to infer both negligent conduct and causation from the mere occurrence of certain events is:

A) proximate cause. B) res ipsa loquitur. C) causation in fact. D) comparative negligence.

A chair manufacturer has two divisions: framing and upholstering. The framing costs are $100 per chair and the upholstering costs are $200 per chair. The company makes 5,000 chairs each year, which are sold for $500.

a. What is the profit of each division if the transfer price is $150? b. What is the profit of each division if the transfer price is $200?