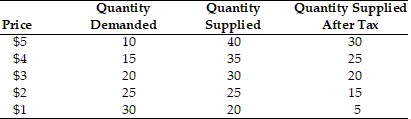

Using the above table, a unit tax of $2 is imposed on the product. How much of the tax is paid by the producer?

Using the above table, a unit tax of $2 is imposed on the product. How much of the tax is paid by the producer?

A. $3

B. $2

C. $1

D. unable to determine

Answer: C

You might also like to view...

Since individual buyers and individual sellers in a competitive market have no influence on the market price, what do we call the buyers and sellers in a competitive market?

Which of the following statements about real and nominal interest rates is correct?

a. When the nominal interest rate is rising, the real interest rate is necessarily rising; when the nominal interest rate is falling, the real interest rate is necessarily falling. b. If the nominal interest rate is 4 percent and the inflation rate is 3 percent, then the real interest rate is 7 percent. c. An increase in the real interest rate is necessarily accompanied by either an increase in the nominal interest rate, an increase in the inflation rate, or both. d. When the inflation rate is positive, the nominal interest rate is necessarily greater than the real interest rate.

Use the table below to answer the following question.UnitsMaximum Willingness to PayMarket PriceMinimum Acceptable Price1$14$8$2212843108648885681064814What is the value of economic surplus in the table above?

A. $8 B. $24 C. $12 D. $0

Summarize the anti growth view of economic growth

Please provide the best answer for the statement.