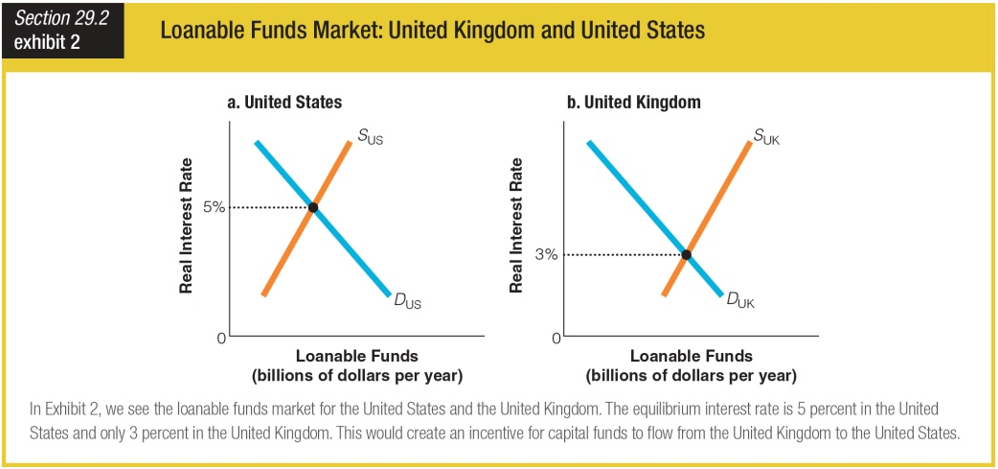

Which of the following statements describes the situation shown?

a. There is an incentive for capital funds to flow from the United States to the United Kingdom.

b. The equilibrium interest rate is 5 percent in the United States and 3 percent in the United Kingdom.

c. U.S. investors will be tempted by the interest rate in the United Kingdom.

d. Investors in the United Kingdom will be tempted to keep their funds in their own country.

b. The equilibrium interest rate is 5 percent in the United States and 3 percent in the United Kingdom.

You might also like to view...

Within the U.S. population, women of prime working age (ages 25-54) have higher rates of unemployment than men of prime working age (ages 25-54), regardless of race

a. True b. False Indicate whether the statement is true or false

Which of the following may not be indicated by low long-term interest rates?

(A) That the economy is expected to contract in coming years. (B) That consumers want to borrow money to invest. (C) The future health of the economy. (D) That businesses do not want to borrow money to invest.

The risk structure of interest rates says:

A. the interest rates on a variety of bonds will move independently of each other. B. lower rated bonds will have higher yields. C. interest rates only compensate for risk during recessions. D. U.S. Treasury bond yields always change by more than other bonds.

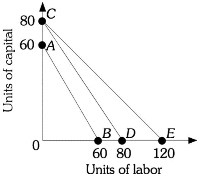

Refer to the information provided in Figure 7.8 below to answer the question(s) that follow.  Figure 7.8Refer to Figure 7.8. The slope of isocost CD is

Figure 7.8Refer to Figure 7.8. The slope of isocost CD is

A. greater than the slope of isocost AB. B. less than the slope of isocost AB. C. equal to the slope of isocost AB. D. indeterminate from this information, as the prices of capital and labor are not given.