If a country chooses to have a monetary policy oriented toward domestic goals and the freedom of international capital movements, then

A) it can have a fixed exchange rate.

B) it cannot have a fixed exchange rate.

C) it cannot balance its current account.

D) it cannot have a fiscal policy oriented toward domestic goals.

E) it cannot control money supply growth.

B

You might also like to view...

European agricultural practices perfectly served the colonists farming in the New World

Indicate whether the statement is true or false

A bank has $10,000 in excess reserves and the required reserve ratio is 20 percent. This means the bank could have __________ in checkable deposit liabilities and __________ in total reserves

A) $80,000, $10,000 B) $100,000, $20,000 C) $50,000, $25,000 D) $100,000, $30,000

In the open-economy macroeconomic model, if a country's interest rate falls, then its

a. net capital outflow and its net exports rise. b. net capital outflow rises and its net exports fall. c. net capital outflow falls and its net exports rise. d. net capital outflow and its net exports fall.

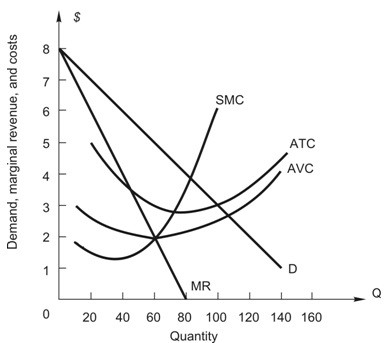

The following figure shows the demand and cost curves facing a firm with market power in the short run. The firm earns profits of

The firm earns profits of

A. $120. B. $180. C. $300. D. $150. E. $75.