The Treasury usually requires most businesses to regularly deposit taxes withheld from employees into accounts at designated commercial banks. On a regular basis, the funds in these accounts are transferred to the Treasury's account at the Fed. Discuss what is happening to the balance sheet of the banking system as the businesses are making deposits and these tax accounts are increasing. What happens to the banking system's balance sheet when the funds are transferred to the Fed?

What will be an ideal response?

As the deposits are made by businesses the liabilities of the banking system are increased since these deposits are assets for the Treasury and liabilities of the banks. The asset side of the balance sheet is also increasing as these funds are adding to reserves. Once the funds are transferred to the Fed the liabilities are decreased by the amount of the transfer but also assets are decreased as the reserve account of the appropriate banks will be debited by the Fed.

You might also like to view...

Minimum wage was first established by ______.

a. city governments b. county governments c. state governments d. the federal government

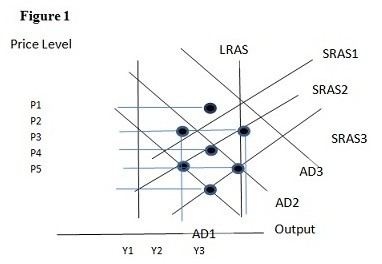

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y2. C. P3 and Y1. D. P2 and Y3.

A firm with market power has an individual consumer demand of Q = 20 ? 4P and costs of C = 4Q. What is optimal price to charge for a block of 20 units?

A. $36 B. $18 C. $90 D. $72

John has $4000 in savings to buy an engagement ring for his girlfriend even though he has no plans to propose in the near future. When his transmission needs to be replaced in his car, John charges the $2000 worth of auto repair. John's decision is an example of:

A. over consumerism. B. people recognizing that money is fungible. C. people making false distinctions about their money. D. everyday expenses being easier to charge than big purchases.