Northwest California Ventures Ltd. has decided to provide capital in five market areas for the start-ups. The investment consultant for the venture capital company has projected an annual rate of return based on the market risk, the product, and the size of the market.

?

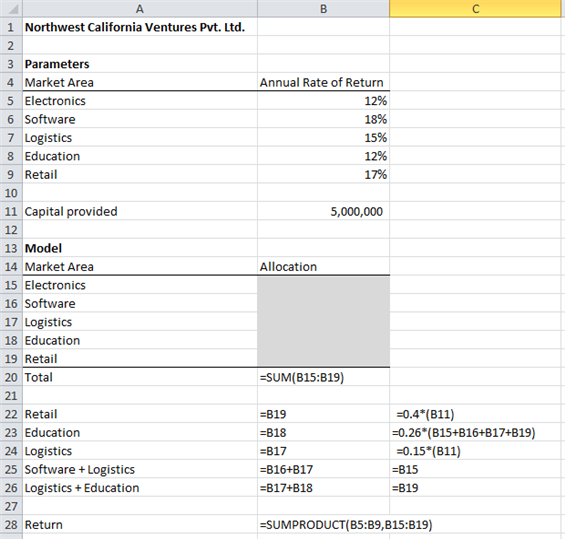

Market AreaAnnual Rate of Return on Capital (%)

Electronics12

Software18

Logistics15

Education12

Retail17

?

The maximum capital provided will be $5 million.

The consultant has imposed conditions on allotment of capital based on the risk involved in the market.

• The capital provided to retail should be at most 40 percent of the total capital.• The capital for education should be 26 percent of the total of other four markets (Electronics, Software, Logistics, and Retail)• Logistics should be at least 15 percent of the total capital.• The capital allocated for Software plus Logistics should be no more than the capital allotted for Electronics.• The capital allocated for Logistics plus Education should not be greater than that allocated to Retail.

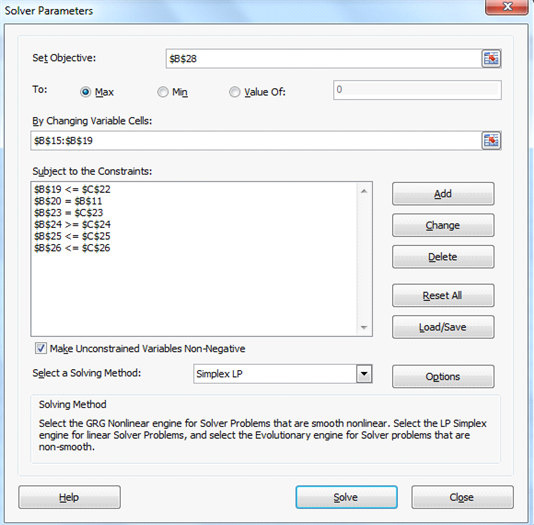

Calculate the expected annual rate of return based on the allocation of capital to each market area to maximize the return on capital provided. Also, show the allocation of capital for each market area.

What will be an ideal response?

Let x1 = investment on Electronics

x2 = investment on Software

x3 = investment on Logistics

x4 = investment on Education

x5 = investment on Retail

Max 0.12x1 + 0.18x2 + 0.15x3 + 0.12x4 + 0.17x5

s.t.

x5? 0.4(5,000,000)

x4 = 0.26 (x1 + x2 + x3 + x5)

x3? 0.15(5,000,000)

x2 + x3£x1

x3 + x4£x5

x1+ x2 + x3 + x4+ x5 = 5,000,000

x1, x2, x3, x4, and x5? 0

?

?

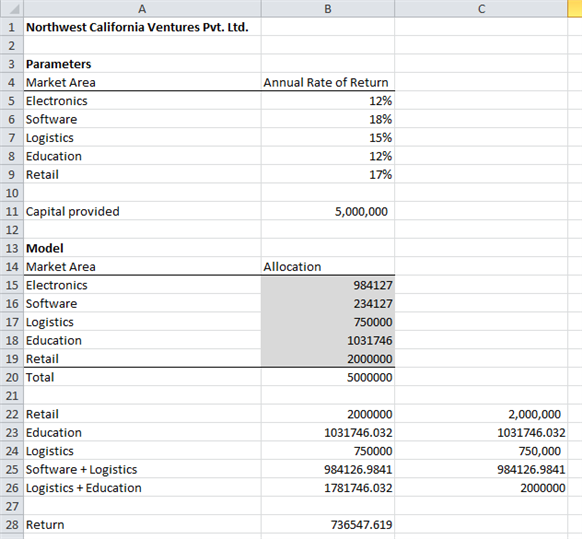

The expected annual rate of return based on the allocation of capital to each of the five market areas, as shown below, is obtained as $736,547.62, approximately.

?

| Market Area | Allocation (approx.) |

| Electronics (x1) | $984,127 |

| Software (x2) | $234,127 |

| Logistics (x3) | $750,000 |

| Education (x4) | $1,031,746 |

| Retail (x5) | $2,000,000 |

| Total | $5,000,000 |

You might also like to view...

Citrus Inc declared and paid cash dividends of $100,000 on common stock and $75,000 on preferred stock. How would these dividends be presented in Citrus' statement of cash flows?

a. As a $100,000 reduction in cash flows from investing activities b. As a $175,000 reduction in cash flows from investing activities c. As a $100,000 reduction in cash flows from financing activities d. As a $175,000 reduction in cash flows from financing activities

What was the employer expected to provide under the old social contract? What is the employer expected to provide under the new social contract?

What will be an ideal response?

BEGIN LOOP DBMS_OUTPUT.PUT_LINE(lv_cnt_num); lv_cnt_num := lv_cnt_num + 1; EXIT WHEN lv_cnt_num >= 5; END LOOP;END;Which of the statements in the code fragment above ensures that the loop executes at least once?

A. LOOP B. lv_cnt_num := lv_cnt_num + 1; C. EXIT WHEN lv_cnt_num >= 5; D. DBMS_OUTPUT.PUT_LINE(lv_cnt_num);

Which theory focuses predominantly on how the leader’s activities relate to the followers and the context in which followers find themselves?

A. trait B. LMX C. adaptive D. authentic