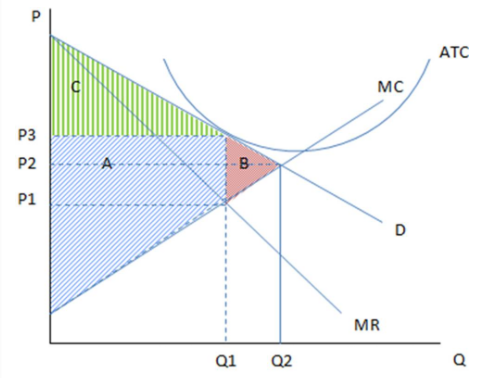

Assuming the firm in the graph is producing Q1 and charging P3, it is likely showing the cost and revenue curves of a firm in:

These are the cost and revenue curves associated with a firm.

A. the long run, and economic profits are zero.

B. the short run, and accounting profits are negative.

C. the long run, and accounting profits are zero.

D. the short run, and economic profits are positive.

A. the long run, and economic profits are zero.

You might also like to view...

When the interest rate on a bond is above the equilibrium interest rate, in the bond market there is excess ________ and the interest rate will ________

A) demand; rise B) demand; fall C) supply; fall D) supply; rise

Suppose a profit-maximizing monopoly is able to employ group price discrimination. The marginal cost of providing the good is constant and the same in both markets

The marginal revenue the firm earns on the last unit sold in the market with the higher price will be A) greater than the marginal revenue the firm earns on the last unit sold in the market with the higher price. B) less than the marginal revenue the firm earns on the last unit sold in the market with the higher price. C) equal to the marginal revenue the firm earns on the last unit sold in the market with the higher price. D) greater than the marginal cost of the last unit.

If we assume that velocity is constant, and if the money supply increases by 6 percent, we would expect, ceteris paribus, that the price level would

A) increase by 3 percent. B) increase by 6 percent. C) decrease by 3 percent. D) decrease by 6 percent.

If Japan has a comparative advantage over Canada in the production of computers, which of the following must be true?

a. Supply of unskilled labor in Japan is higher than that in Canada. b. Japan incurs a lower input cost in the production of computers. c. Japan incurs a higher input cost in the production of computers. d. Japan has a lower opportunity cost in the production of computers. e. Japan has a higher opportunity cost in the production of computers.