A reduction in the capital gains tax, often advocated by proponents of supply-side economics, is supposed to stimulate increased

A. consumer spending.

B. net exports.

C. investment spending.

D. government spending.

Answer: C

You might also like to view...

On the "supply side" of a market, producers indicate to consumers what they are willing to sell, in what quantity and at what price

Indicate whether the statement is true or false

If the Fed increases the quantity of money, then

A) aggregate demand increases and the AD curve shifts rightward. B) the quantity of real GDP demanded decreases and there is a movement up along the AD curve. C) both the aggregate demand curve and the aggregate supply curve shift leftward. D) aggregate demand decreases and the AD curve shifts leftward. E) the quantity of real GDP demanded increases and there is a movement down along the AD curve.

Who believes that two-income families today are worse off than their one-income counterparts were in the 1970s?

A. Barbara Ehernreich B. Beth Schulman C. Elizabeth Warren and Amelia Warren Tyagi D. Jose Conseco

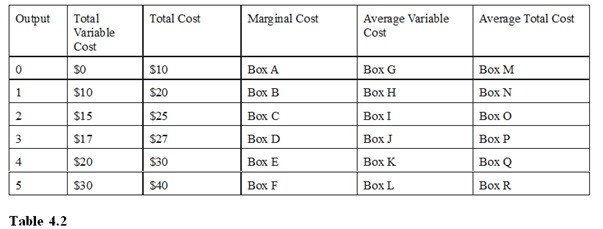

Referring to Table 4.2, Box D should be filled with

A. $2. B. $17. C. $27. D. $0.