Short-term ____________________________ represents a firm's near-term ability to generate cash to service working capital needs and debt service requirements

Fill in the blank(s) with correct word

liquidity risk

You might also like to view...

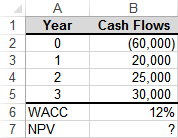

Which is the right formula for B7?

a) =NPV(B6,B2:B5)

b) =NPV(B6,B3:B5)-B2

c) =NPV(B6,B3:B5)+B2

d) =NPV(B6,B2:B5)+B2

e) =NPV(B6,B2:B5)-B2

The following totals for the month of June were taken from the payroll register of Young Company: Salaries expense $15,000 Social security and Medicare Taxes withheld 1,125 Income Taxes withheld 3,000 Retirement Savings 500 Salaries subject to federal and state unemployment taxes of 6.2 percent 4,000 The entry to record the accrual of employer's payroll taxes would include a

A) debit to Payroll Taxes Expense for $2,498 B) credit to Social Security and Medicare Tax Payable for $2,250 C) debit to Payroll Taxes Expense for $1,373 D) Debit to Payroll Tax Expense for $1,125

Managers must commit to a ________ use of the balanced scorecard if they expect sustained performance.

A. long-term B. interim C. rapid D. short-term

You wish to diversify your single-security portfolio in a way that will maximize your reduction in risk. Which of the following securities should you add to your portfolio?

A) Treasury bills that have a correlation coefficient of 0.0 with your current security B) Alpha Company stock that has a correlation coefficient of -0.25 with your current security C) Beta Company stock that has a correlation coefficient of 0.50 with your current security D) Delta Company bonds that have a correlation coefficient of 0.36 with your current security