If the production of a product or service involves external or spillover benefits, then the government can improve efficiency in the market by:

A. imposing a corrective tax to correct for an overallocation of resources.

B. providing a subsidy to correct for an underallocation of resources.

C. imposing a corrective tax to correct for an underallocation of resources.

D. providing a subsidy to correct for an overallocation of resources.

Answer: B. providing a subsidy to correct for an underallocation of resources.

You might also like to view...

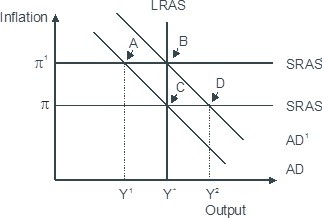

Based on the figure below. Starting from long-run equilibrium at point C, a tax cut that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. B; C C. B; A D. D; B

The quantity of money is $1 billion, the price level is 1.10, and real GDP is $10 billion. What is the velocity of money?

What will be an ideal response?

Which of the following will NOT increase a worker's human capital?

A) more work experience B) more training C) more schooling D) a higher wage rate

Which of the following is a government purchase?

a. The income tax b. The property tax c. Social Security benefits paid to a retired government worker d. Food stamps e. The salary of a federal judge