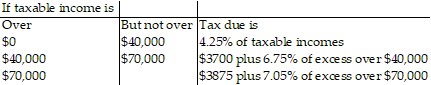

Solve the problem.The following table shows a recent state income tax schedule for married couples filing a joint return in State X.State X Income TaxSCHEDULE I - MARRIED FILING JOINTLY (i) Write a piecewise definition for the tax due T(x) on an income of x dollars. (ii) Graph T(x). (iii) Find the tax due on a taxable income of $50,000. Of $95,000.

(i) Write a piecewise definition for the tax due T(x) on an income of x dollars. (ii) Graph T(x). (iii) Find the tax due on a taxable income of $50,000. Of $95,000.

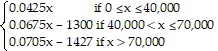

A. (i)

T(x) =

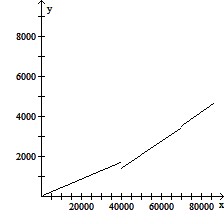

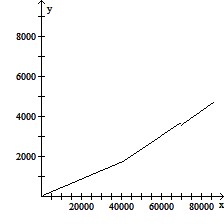

(ii)

(iii) $2385; $5697.50

B. (i)

T(x) =

(ii)

(iii) $2075; $5270.50

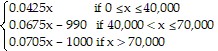

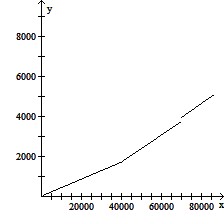

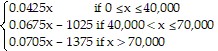

C. (i)

T(x) =

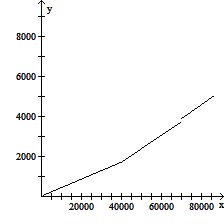

(ii)

(iii) $2375; $5637.50

D. (i)

T(x) =

(ii)

(iii) $2350; $5322.50

Answer: C

You might also like to view...

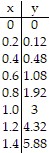

Use the table to find the instantaneous velocity of y at the specified value of x.x = 1.

A. 2 B. 4 C. 6 D. 8

Calculate the derivative of the function. Then find the value of the derivative as specified. ? =2 if r =

? =2 if r =

A.  =

=  ;

;  ? =2

? =2

=

B.  = -

= -  ;

;  ? =2

? =2

= -

C.  = -

= -  ;

;  ? =2

? =2

= -

D.  =

=  ;

;  ? =2

? =2

=

Write the satement in symbols. Let x represent the unknown number.The product of -18 and the sum of a number and 6.

A. -18x + 6 B. -108x C. -18(x + 6) D. -18 + 6x

Between each pair of numbers, insert the appropriate sign, <, =, or >, to make a true statement.1.6 1.75

A. 1.6 > 1.75 B. 1.6 = 1.75 C. 1.6 < 1.75