The United States could begin building a new type of flat-panel, three-dimensional television (FP3D). However, Japanese firms have been producing such televisions for a couple of years and are already low-cost, high-quality producers. Should the United States impose temporary protection in the form of a tariff on this product to protect the domestic industry until it is mature enough to compete with the Japanese producers? Why or why not?

What will be an ideal response?

POSSIBLE RESPONSE: This situation relates to the infant industry argument. The infant industry argument asserts that protection is justified temporarily until domestic producers learn how to produce at low enough cost, and eventually be able to compete without a tariff. To be able to answer the question, the government should compare the future producer surplus to the cost to the country while the tariff is in place. A problem for the government is in assessing whether U.S. producers will eventually become efficient enough to compete internationally and realize surpluses.

According to the infant industry argument, firms make losses when they begin operation and then become profitable later on. The protection would be the right choice under two circumstances. One would be the circumstance in which there are imperfections in the financial markets and firms do not have access to financial capital. U.S. firms are unlikely to suffer from this problem as the United States has well-developed financial markets. The second circumstance would be the case in which the future profits resulting from early business investments do not accrue to the firms making these early investments. Again, this may be unlikely to happen in the United States due to its well-developed patent laws. So, we can see that both scenarios do not provide much support for temporary protection to be offered to these firms in the United States.

You might also like to view...

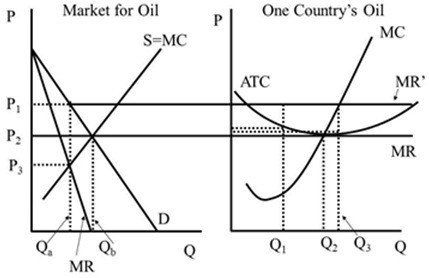

Under the cartel, the price is  Figure 42.2

Figure 42.2

A. P1. B. P2. C. P3. D. 0.

As the economy nears the end of an expansion, interest rates usually ________ and wages rise more ________ than prices

A) fall; rapidly B) fall; slowly C) rise; slowly D) rise; rapidly

The nominal exchange rate is 30 Thai bhat for one U.S. dollar. A sub sandwich combo deal in the U.S. costs $6 dollars in the U.S. and 120 bhat in Thailand. The real exchange rate is

a. 3/8 b. 2/3 c. 3/2 d. 8/3

Capital, as economists use the term,

A. is the money the firm spends to hire resources. B. refers to things that have already been produced that are in turn used to produce other goods and services. C. is money the firm raises from selling stock. D. refers to the process by which resources are transformed into useful forms.