The supply-side effect of higher tax rates would include a fall in the economy's potential GDP

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

EBay

A) will be considered a market when the Internet firms are profitable. B) is a market because buyers and sellers are brought together to buy and sell. C) cannot function as a market. D) would be a market if there was only one physical location. E) is not a market because buyers can buy from only one seller at any point in time.

Ricardian equivalence is the proposition that

A) government expenditure should only be financed by taxes. B) it does not matter whether government expenditure is financed by creating new money or issuing debt. C) government expenditure should only be financed by issuing new debt. D) it does not matter whether government expenditure is financed by taxes or debt.

When Fred's income was $100 per week, 10 units of good X were demanded. Now his income is $150 per week and 12 units of good X are demanded. Using the percentage change formula, the income elasticity of demand for good X equals

A) 0.45. B) 0.40. C) 2.20. D) 2.50.

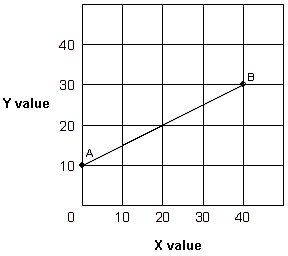

Exhibit 1A-1 Straight line

A. decreases with increases in X. B. increases with increases in X. C. increases with decreases in X. D. remains constant with changes in X.