Under current tax law individuals do not pay taxes on health insurance benefits they receive from their employers. As a result

A) the quality of health care provided is less than it would be if benefits were taxed.

B) politicians are encouraged to raise income and payroll taxes.

C) individuals are encouraged to want generous health coverage that reduces their incentives to cut costs.

D) the federal government spends more than it receives in tax revenue.

C

You might also like to view...

A reason why there is more competition among restaurants than among large discount department stores is that restaurants

A) have more elastic demand for their product compared to department stores. B) unlike department stores, do not have significant economies of scale. C) unlike department stores, have to abide by government sanitation rules. D) have to cater to a variety of consumer tastes while department stores do not.

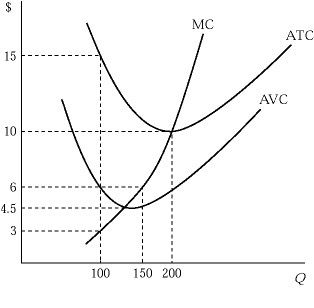

Figure 9.3Figure 9.3 shows the cost structure of a firm in a perfectly competitive market. The firm will stay in the market in the long run only if the market price is greater than or equal to:

Figure 9.3Figure 9.3 shows the cost structure of a firm in a perfectly competitive market. The firm will stay in the market in the long run only if the market price is greater than or equal to:

A. $4.50. B. $6. C. $10. D. $15.

In 2009, the return on American investments abroad was _____ the return earned by foreigners on their investments in the U.S.

A. larger than B. about equal to C. smaller than

Suppose that an economy produces 300 units of output, employing the 50 units of input, and the price of the input is $9 per unit. The level of productivity and the per-unit cost of production are, respectively:

A. 1.50 and $6.00 B. 6 and $1.50 C. 5 and $6.00 D. 5 and $1.50