most frequently the federal reserve implements monetary policy by

What will be an ideal response?

conducting open market operations

You might also like to view...

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $500 billion, (2) investment = $50 billion, (3) government purchases = $100 billion, and (4) net exports = $20 billion. If the full-employment level of GDP for this economy is $620 billion, then what combination of actions would be most consistent with closing the GDP-gap here?

A. An increase in government purchases and a decrease in taxes B. A decrease in government purchases and taxes C. An increase in government purchases and taxes D. A decrease in government purchases and an increase in taxes

Marginal tax rates and average tax rates are rarely the same. What happens to the relationship between marginal tax rates and average tax rates as incomes rise in the highest tax brackets?

What will be an ideal response?

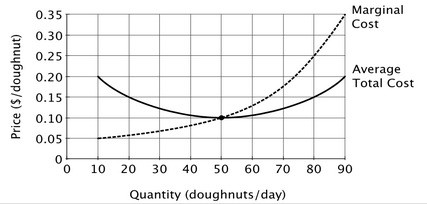

Refer to the accompanying figure. If the market for doughnuts is perfectly competitive, then assuming this firm can earn enough revenue to cover its variable cost, it should produce:

A. the quantity of doughnuts at which average total cost is minimized. B. the quantity of doughnuts at which marginal cost equals the market price. C. 50 doughnuts per day. D. the quantity of doughnuts at which average total cost equals the market price.

The equation of exchange is a formula indicating that the number of monetary units times

A. nominal Gross Domestic Product (GDP) is identical to the price level times the number of times each monetary unit is spent on final goods and services. B. real Gross Domestic Product (GDP) is identical to the price level times the number of times each monetary unit is spent on final goods and services. C. the number of times each monetary unit is spent on final goods and services is identical to the price level times real Gross Domestic Product (GDP). D. the price level is identical to the number of times each monetary unit is spent on final goods and services times real Gross Domestic Product (GDP).