Individuals Jimmy and Ellen form JE Corporation. Ellen transfers land and a building with a $175,000 adjusted basis and $200,000 FMV in exchange for 50% of the stock of the JE Corporation and a $20,000 note. Jimmy transfers cash of $200,000 for 50% of the stock and a $20,000 note. The transaction meets the terms of Sec. 351. The JE stock has a fair market value of $360,000. What is:

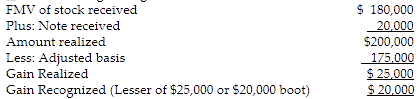

a. the amount of Ellen's gain or loss recognized on the transfer?

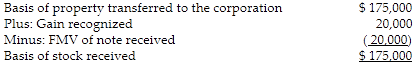

b. the basis of her stock in JE Corporation?

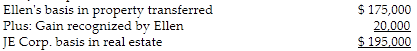

c. JE Corporation's basis in the land and building (together) transferred by Ellen?

a. Ellen's recognized gain:

b. Ellen's basis in the stock:

c. JE Corporation's basis in the real estate:

You might also like to view...

When a foreign currency is worth more in the forward market than in the spot market, it is said to be at a discount in the forward market.

a. True b. False

Any terms in the report that are unfamiliar to the audience should be defined in the

A) introduction. B) body. C) explanatory notes. D) summary. E) appendix.

Which of the following statements is TRUE of partnerships?

A) If the partners have no partnership agreement specifying how to divide profits and losses, then they share profits and losses equally. B) It is legally required to share the profit and losses equally, irrespective of the partnership agreement. C) The stated ratio of profit sharing needs to be approved by the SEC. D) The profit sharing is always based on each partner's capital balances and any losses will be shared equally.

Ruth Boller, marketing manager at Hi Mountain Water, is looking to learn more about how ongoing plans and implementation are working and how she can plan for the future. This process is called

A. modeling. B. design. C. control. D. implementation. E. forecasting.