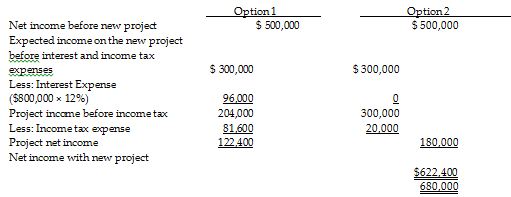

Campbell, Inc. has net income of $500,000 and 200,000 shares of common stock. The company is considering a project that requires $800,000 and is considering two options:

• Option 1 is to borrow $800,000 at 12%.

• Option 2 is to issue 100,000 shares of common stock for $800,000.

Considering all relevant facts and figures, Campbell's management is of the opinion that the funds raised can be used to increase income before interest and taxes by $300,000 each year. The company estimates income tax expense to be 40%. Analyze the Campbell situation to determine which plan will result in higher earnings per share. (Round your answers to two decimal points.)

You might also like to view...

An example of intangible property is a ________.

A. music player B. patent C. felled tree D. tract of land

With reference to pricing in different types of markets, compare oligopolistic competition with a pure monopoly

What will be an ideal response?

You can cue the audience that you are about to stop speaking by all of the following EXCEPT

a. decreasing your speaking rate. b. increasing your speaking rate. c. altering your voice tone. d. shouting.

In a partnership, each member of the project team is responsible for the project's outcomes and the current situation, whether it is positive or shows evidence of project problems. The term that BEST describes this responsibility is:

A) Exchange of purpose. B) A right to say no. C) Joint accountability. D) Absolute honesty.