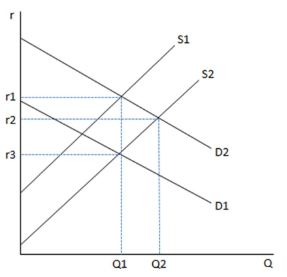

Suppose investors become more optimistic that the economy will be doing well over the next decade. How will the market for loanable funds as depicted in the accompanying graph be affected?

A. Supply will shift to the right from S1 to S2.

B. Supply will shift to the left from S2 to S1.

C. Demand will shift to the right from D1 to D2.

D. Demand will shift to the left from D2 to D1.

C. Demand will shift to the right from D1 to D2.

You might also like to view...

If the price elasticity of demand is less than 1, a monopoly's

A) total revenue increases when the firm lowers its price. B) total revenue decreases when the firm lowers its price. C) marginal revenue is undefined. D) marginal revenue is zero.

What is a zero-sum game? Can you think of any zero-sum games in real life?

What will be an ideal response?

Refer to Scenario 15.4. The present value of the electricity bill savings you will receive over the next 10 years is

A) $200 times 10. B) $200/1.06. C) $200/1.0610. D) $200 (1 + 1/1.06 + 1/1.062 + ... + 1/1.069 ). E) $200 / (1 + 1/1.06 + 1/1.062 + ... + 1/1.069 ).

If there are two goods and two countries, then one country can have

A) an absolute advantage in only one good. B) an absolute advantage in both goods. C) a higher opportunity cost of producing both goods. D) a lower opportunity cost of producing both goods.