Which of the following statements is correct regarding the imposition of a tax on gasoline?

a. The incidence of the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

b. The incidence of the tax depends upon the price elasticities of demand and supply.

c. The amount of tax revenue raised by the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

d. The amount of tax revenue raised by the tax does not depend upon the amount of the tax per unit.

b

You might also like to view...

Under which of the following situations would a seller prefer to incur the cost of improving the product quality?

a. If the increase in buyer's valuation for the improved product is higher than the cost of improving it. b. If the increase in the seller's opportunity cost of improving the product is higher than the price of the product. c. If the product improvement lowers the producer surplus. d. If the product improvement allows the seller to a break even.

In terms of the production possibilities diagram, the principle of increasing cost simply asserts that the frontier is

a. downward sloping. b. upward sloping. c. bowed inward. d. bowed outward. e. undefined, because no market will exist in this case.

Which of the following is always true in competitive price-taker markets?

a. There are more sellers than buyers. b. Barriers to entry into the market are low. c. The products of firms in the industry are differentiated. d. The firms never earn economic profit.

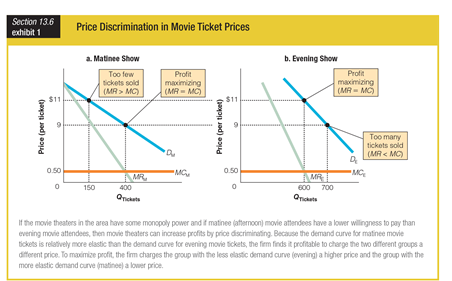

Based on the graphs showing price discrimination in movie ticket prices, an elastic demand curve prompts theatres to ______.

a. charge higher prices

b. charge lower prices

c. go bankrupt

d. add more seats