The unadjusted trial balance and the adjustment data for Porter Business Institute are given below along with adjusting entry information. What is the impact on net income if these adjustments are not recorded? Show the calculation for net income without the adjustments and net income with the adjustments. Which one gives the most accurate net income? Which accounting principles are being violated if the adjustments are not made? Porter Business Institute Unadjusted Trial Balance December 31 (in millions)?Cash…………………………………………………. ?$58,000??Accounts receivable…………..………………59,000??Prepaid insurance …………………………...12,000??Equipment

…………………………………….8,000??Accumulated depreciation-equipment ……….. ??$ 2,000Buildings……………………………………………..57,500??Accumulated depreciation-buildings…………..??17,500Land………………………………….55,000??Unearned rent…………………………………..??16,000Long-term notes payable……………………….??50,000Common stock……………………….??50,000Retained earnings ……………………………….??65,600Tuition fees earned ……………………….??74,000Training fees earned ………………………….??23,400Wages expense ……………………………………...32,000??Utilities expense …………………………….8,000??Property taxes expense …………………………5,000??Interest expense …………………………………….4,000?________Totals ………………………………………..$ 298,500?$298,500Additional information items:a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

What will be an ideal response?

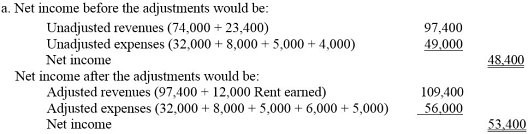

The accrual basis gives the most accurate net income because it requires all revenues to be recorded when earned and all expenses to be recorded when incurred. This follows the expense recognition (matching) principle which states that expenses of the period should be matched with revenues of the period. There is a net increase of $5,000 in net income. Revenues increase by $12,000 to recognize the rent earned. Expenses increase by $7,000; a $6,000 increase in Insurance Expense and a $1,000 increase in Interest Expense.

You might also like to view...

There are three methods of accounting for a business combination

Indicate whether the statement is true or false

Which of the following is true of a fully disclosed agency?

A) The third party does not know the identity of the principal. B) The third party knows the name of the principal, but all transactions are done with the agent. C) The contract is between the principal, agent, and the third party. D) The principal is liable on the contract with a third party.

How does an easement appurtenant differ from an easement in gross?

A) An easement appurtenant is permanent. B) An easement appurtenant is in writing. C) The right to enter the land exists only for an easement appurtenant. D) The dominant estate of an easement appurtenant is adjacent to the servient estate. E) An easement appurtenant must be recorded.

Excluding stocks traded in the United States, a stock that is traded in a country other than the issuing company's home country is called a ________.

A. Class B stock B. Yankee stock C. Euro stock D. Global classified equity E. Preferred stock