Current tax rates are insufficient to finance the benefits promised by both the Social Security and Medicare programs. Are these unfunded promises surprising according to economic theory?

a. Yes, political representatives have a strong incentive to levy taxes that are sufficient to cover the cost of all programs they favor.

b. No, the unfunded promises reflect the shortsighted nature of the political process.

c. Yes, political representatives generally favor balancing the government budget because this is best for the economy.

d. No, even though debt financing often makes sense, politicians are reluctant to use it because it will damage their chances of being reelected.

B

You might also like to view...

For a country in autarky, the opportunity cost of the good on the horizontal axis is the same as

A) the relative price of the good on the vertical axis. B) the relative price of the good on the horizontal axis. C) the opportunity cost of the good on the vertical axis. D) Both A and C. E) None of the above.

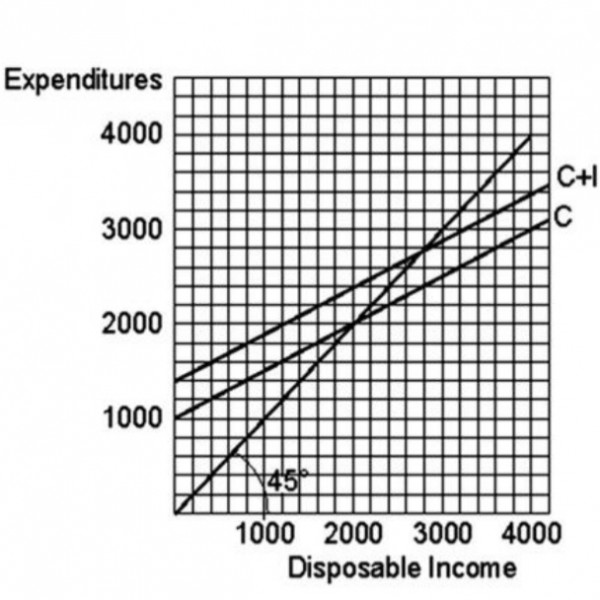

In the above graph, when disposable income is 1,000, saving is

A. 500.

B. 400.

C. -500.

D. -400.

The advantage of real GDP as a measure is the fact that it only increases

a. True b. False Indicate whether the statement is true or false

In a closed economy, GDP is $1000, government purchases are $200, and consumption is $700 . If the government has a budget surplus of $25, what are investment, taxes, private saving, and national saving?