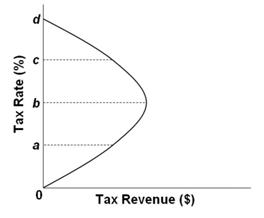

Refer to the graph below. If tax rates are between b and d, then supply-side economists are of the opinion that a(n):

A. Increase in tax revenues will increase tax rates

B. Decrease in tax rates will increase tax revenues

C. Increase in tax rates will increase tax revenues

D. Decrease in tax revenues will decrease tax rates

B. Decrease in tax rates will increase tax revenues

You might also like to view...

AC is lower in the long run than in the short run because

A. prices often fall, allowing savings on purchases. B. inputs can be combined more efficiently in the long run. C. over time the prices of all inputs tend to decrease. D. AFC falls with output over all ranges of output.

"Allocative efficiency requires that the maximum number of people have access to all of the goods and services that our economy produces." Is this statement true or false? Explain your answer

What will be an ideal response?

The above table gives some of the costs of the Delicious Pie Company. What is the average variable cost of producing 300 pies?

A) $1,800 B) $6 C) $5 D) More information is needed to calculate the average variable cost.

The price of a barrel of oil doubled between 2007 and the middle of 2008. To make matters worse, a financial crisis hit the U.S. economy starting in August of 2007

Which of the following is an appropriate description of the mechanism that would have ensued? A) The increase in the price of oil would have immediately shifted the AS curve to the right. B) The financial crisis would have led to a sharp contraction in spending shifting the AD curve to the right. C) Shifts in both the AD and the AS curve would have ensued in the short-run but as long as neither shock had an impact on potential output, ultimately unemployment will have been unaffected in the long run. D) All of the above. E) None of the above.