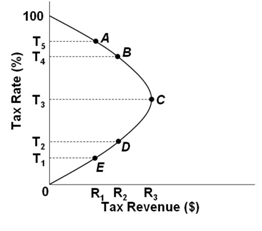

Refer to the Laffer Curve above. A cut in the tax rate from T5 to T4 would:

A. Decrease tax revenues and support the views of supply-side economists

B. Increase tax revenues and support the views of supply-side economists

C. Increase tax revenues and support the views of mainstream economists

D. Decrease tax revenues and support the views of mainstream economists

B. Increase tax revenues and support the views of supply-side economists

You might also like to view...

Suppose the growth in GDP per hour resulting from physical capital in an economy is 1% and the growth resulting from human capital is 2%. If the annual growth rate of GDP per hour is 5%, the growth resulting from technology equals:

A) 4%. B) 3%. C) 2%. D) 1%.

The cost of building a blast furnace for an iron and steel firm would be categorized as a: a. total cost

b. fixed cost. c. variable cost. d. marginal cost.

Countries like Argentina and Australia protect agriculture less heavily than other agricultural producers because

A) they have a large comparative advantage in production. B) it is illegal under WTO rules. C) they do not have significant agricultural sectors. D) they are trying to help other countries.

In what ways do entrepreneurs differ from other innovators? In what types of businesses do entrepreneurs and innovators tend to work? How do past successes affect these types of individuals?

What will be an ideal response?