A Social Security system in which payroll taxes that workers and their employers pay in go directly to retirees and other beneficiaries is known as

A) a pay-as-you-go system.

B) an individual-account system.

C) a primary-deficit system.

D) a social-lockbox system.

A

You might also like to view...

Provide a utilitarian justification for using the tax system to provide a more equal distribution of income as well as two possible counterarguments to this viewpoint

What will be an ideal response?

As long as the marginal utilities per dollar obtained from the last unit of all products consumed are the same, _____

a. the consumer is in equilibrium and will not reallocate income b. the consumer is not in equilibrium and will reallocate income c. the consumer is most likely operating a budget deficit d. the consumer is not maximizing utility e. the government will recognize this as an intolerable disequilibrium and will most likely intervene by imposing a tax and reallocate the consumer's income

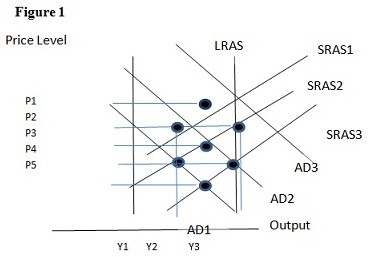

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.

The elasticity closest to unit elastic would be

A. 0. B. 0.2. C. 1.4. D. 5.