Explain and demonstrate graphically how targeting nonborrowed reserves can result in federal funds rate instability

What will be an ideal response?

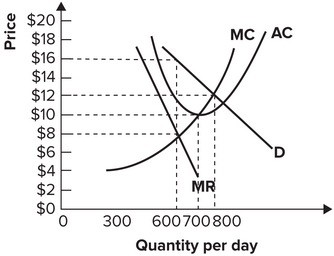

See figure below.

When nonborrowed reserves are held constant, increases in the demand for reserves result in the federal funds rate increasing and decreases in the demand for nonborrowed reserves result in the federal funds rate declining. Since fluctuations in demand do not cause monetary policy actions, the result is the federal funds rate will fluctuate (assuming the equilibrium federal funds rate is below the discount rate).

You might also like to view...

Deflation refers to time periods when the buying power of money in terms of goods and services decreases

a. True b. False Indicate whether the statement is true or false

An outcome is said to be efficient if an economy is getting all it can from the scarce resources it has available

a. True b. False Indicate whether the statement is true or false

Refer to the graph shown. If this monopolist sets the price to maximize profit, it will charge:

A. $8 for its product. B. $16 for its product. C. $10 for its product. D. $12 for its product.

Give an example not in the text of how quantity can become indeterminate.

What will be an ideal response?