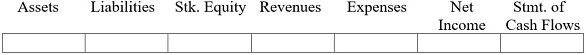

Use the information below to answer the following question(s):Indicate how each event affects the elements of the financial statements. Use the following letters to record your answer in the box shown below each element. Use only one letter for each element. You do not need to enter amounts.Increase = I Decrease = D No Effect = NA(Note that "No Effect" means that the event does not affect that element of the financial statements or that the event causes an increase in that element and is offset by a decrease in that same element.) Cooper Corporation purchased 500 shares of its own stock as treasury stock for $35 per share. The no-par stock had originally been issued by Cooper at $26 per share.

style="vertical-align: 0.0px;" height="55" width="586" />

What will be an ideal response?

(D) (NA) (D) (NA) (NA) (NA) (D)

Purchasing treasury stock decreases assets (cash) and decreases stockholders' equity by increasing the contra equity account treasury stock. It is reported as a cash outflow in the financing activities section of the statement of cash flows.

You might also like to view...

Which of the following is not a business transaction?

A) make a sales offer B) sell goods for cash C) receive cash for services to be rendered later D) pay for supplies

Three basic classifications of domestic mail include the following: First Class Mail, Priority Mail, and Overnight Mail

Indicate whether the statement is true or false.

Sarita has been having difficulty getting a bank loan to help finance startup costs for her new food truck business. Which of the following can help a bank feel more confident in lending money to support Sarita's new enterprise?

A) Sarita's business model B) Small Business Administration support C) urban enterprise zone participation D) references from family E) angel investor support

Distribution channels are organized structures of buyers and sellers that bridge the gap of _______ between manufacturer and customer

a. time b. demand c. space d. a and b only e. a and c only