Ellie has been working for an engineering firm and earning an annual salary of $80,000 . She decides to open her own engineering business. Her annual expenses will include $15,000 for office rent, $3,000 for equipment rental, $1,000 for supplies, $1,200 for utilities, and a $35,000 salary for a secretary/bookkeeper. Ellie will cover her start-up expenses by cashing in a $20,000 certificate of

deposit on which she was earning annual interest of $500 . According to Ellie's accountant, which of the following revenue totals will yield her business $50,000 in profits?

a. $55,200

b. $105,200

c. $132,500

d. $185,700

b

Economics

You might also like to view...

The Earned Income Tax Credit was created in _____

a. 1970 b. 1975 c. 1982 d. 1991

Economics

A price that discourages entry is called a

A) fair price B) limit price C) minimum price D) all of these choices

Economics

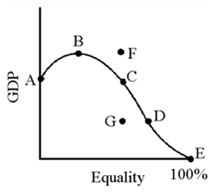

Figure 21-1

A. A and B B. C and D C. D and E D. B and E

Economics

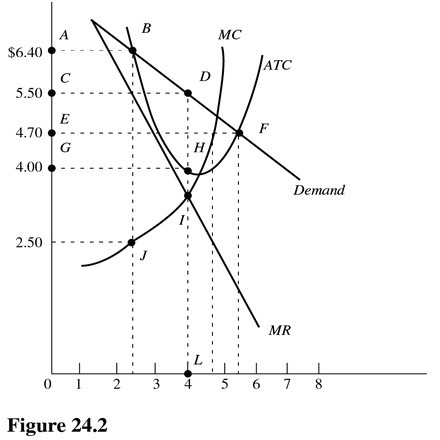

In Figure 24.2, the profit-maximizing level of output is

In Figure 24.2, the profit-maximizing level of output is

A. Between 4 and 5 units. B. 4 units. C. Between 2 and 3 units. D. Between 5 and 6 units.

Economics