State and local governments receive the largest amount of revenue from

A. personal income taxes.

B. property taxes.

C. sales taxes.

D. payroll taxes.

C. sales taxes.

You might also like to view...

The Keynesian theory is consistent with the business cycle fact that inflation is

A) procyclical and leading. B) procyclical and lagging. C) countercyclical and leading. D) countercyclical and lagging.

The marginal productivity theory of income distribution holds that ______.

a. the most productive employees increase income by maximizing the substitution effect b. owners of the means of production receive higher payments than workers or land owners c. labor, land, and capital owners are all paid for the value of their contribution to output d. union workers will receive higher wages than nonunion workers for comparable labor

The equilibrium price and quantity in a market usually produce allocative efficiency because:

A. all consumers who want the good are satisfied. B. marginal benefit and marginal cost are equal at that point. C. equilibrium ensures an equitable distribution of output. D. the excess of goods produced at equilibrium guarantees that all will have enough.

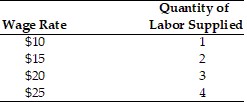

Use the above table. If the marginal revenue product is $20, how many workers will the profit maximizing monopsonist hire?

Use the above table. If the marginal revenue product is $20, how many workers will the profit maximizing monopsonist hire?

A. 1 B. 2 C. 3 D. 4