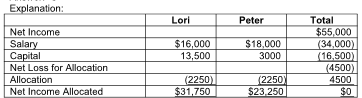

For the year ending December 31, 2019, the partnership reported net income of $55,000. What is Lori's share of the net income?

Lori and Peter enter into a partnership and decide to share profits and losses as follows:

1. The first allocation is a salary allowance with Lori receiving $16,000 and Peter receiving $18,000.

2. The second allocation is 15% of the partners' capital balances at year end. On December 31, 2019, the

capital balances for Lori and Peter are $90,000 and $20,000, respectively.

3. Any remaining profit or loss is allocated equally.

A) $29,500

B) $20,250

C) $31,750

D) $23,250

C) $31,750

You might also like to view...

Generally, federal administrative agencies are created by:

a. Congress. b. the President. c. the Supreme Court. d. the United States Constitution.

A principal has the right to control an agent's conduct in matters entrusted to the agent

a. True b. False Indicate whether the statement is true or false

Which of the following physical distribution functions involves design and operation of facilities for storing goods?

A. Order processing B. Materials handling C. Transportation D. Warehousing E. Inventory management

Suppose 90-day investments in Britain have a 6% annualized return and a 1.5% quarterly (90-day) return. In the U.S., 90-day investments of similar risk have a 4% annualized return and a 1% quarterly (90-day) return. In the 90-day forward market, 1 British pound equals $1.65. If interest rate parity holds, what is the spot exchange rate?

A. 1 pound = $1.8000 B. 1 pound = $1.6582 C. 1 pound = $1.0000 D. 1 pound = $0.8500 E. 1 pound = $0.6031