If the dollar interest rate is 10 percent, the euro interest rate is 12 percent, then

A) an investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

B) an investor should invest only in euros an investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

C) an investor should be indifferent between dollars and euros an investor should invest only in dollars if the expected dollar appreciation against the euro is 4 percent.

D) an investor should invest only in dollars.

E) an investor should invest only in euros.

A

You might also like to view...

Which of the following would shift a nation's production possibilities frontier outward?

A) an increase in demand for the nation's products B) discovering a cheaper way to convert sunshine into electricity C) a decrease in the unemployment rate D) a law requiring workers to retire at age 50

The transactionary demand for money is

(a) An active balance. (b) Directly related to interest rates. (c) Negatively related to income. (d) An idle balance

Economists concerned about economy-wide trends in the unemployment of labor, the rate of inflation, and the level of economic production are studying:

A) microeconomics. B) macroeconomics. C) specific units or parts of the economy. D) the "trees" of economic behavior, rather than the "forest."

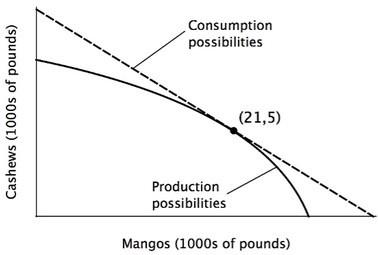

The accompanying figure shows the annual production possibilities curve for a small country that is open to trade with the rest of the world. Suppose the world price of cashews is $12 per pound, and the world price of mangos is $4 per pound. As indicated in the figure, at these prices, this country will produce 21,000 pounds of mangos and 5,000 pounds of cashews each year. At this country's current level of production, what is the opportunity cost of a pound of mangos in terms of cashews?

At this country's current level of production, what is the opportunity cost of a pound of mangos in terms of cashews?

A. 21/5 pounds of cashews B. 3 pounds of cashews C. 1/3 pounds of cashews D. 5/21 pounds of cashews