A sales tax is divided so that the

A) buyers pay the full amount if demand is perfectly elastic.

B) buyers pay the full amount if supply is perfectly inelastic.

C) sellers pay the full amount if supply is perfectly elastic.

D) sellers pay the full amount if demand is perfectly elastic.

D

You might also like to view...

If the autarky price of S (in terms of T) were lower in country A than in country B,

A) A has a comparative advantage in S. B) B has a comparative advantage in T. C) A has a comparative disadvantage in T. D) All of the above.

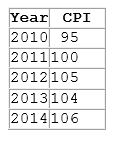

According to the table shown, what happened to the cost of living from 2013 to 2014? The cost of living:

A. increased; consumers became worse off than they would have been if the price level had not changed.

B. decreased; consumers became worse off than they would have been if the price level had not changed.

C. increased; consumers became better off than they would have been if the price level had not changed.

D. decreased; consumers became better off than they would have been if the price level had not changed.

Public goods are not free. If we need a fighter aircraft, we are obliged to give up something else that could have been provided with the resources used to make the aircraft. The opportunity cost of providing aircraft can be represented in the

a. paradox of thrift b. aggregate expenditure curve c. marginal propensity to consume d. innovation cycle e. production possibilities curve

Who pays a corporate income tax?

a. owners of the corporation b. customers of the corporation c. workers of the corporation d. All of the above are correct.