The equilibrium increase in marginal costs for firms resulting from the imposition of a price floor will be larger the more inelastic the price elasticity of demand is.

Answer the following statement true (T) or false (F)

False

Rationale: It will be smaller the more price inelastic demand is. (See Graph 18.8.)

You might also like to view...

The self-correcting tendency of the economy means that falling inflation eventually eliminates:

A. exogenous spending. B. recessionary gaps. C. expansionary gaps. D. unemployment.

What is the most likely effect of legislated rent controls on the rental vacancy rate in an area adopting such controls?

A) The vacancy rate will not change because rent controls don't change the demand (curve) for housing. B) The vacancy rate will rise because owners will be less eager to have tenants in their buildings. C) The vacancy rate will fall because rent controls create a shortage situation. D) The vacancy rate will become wholly arbitrary and unpredictable because allocation decisions will have to be made by political rather than economic criteria.

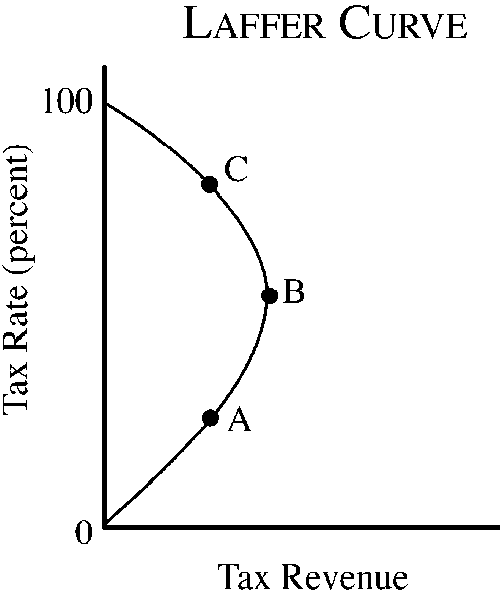

Figure 4-11 Refer to. On the Laffer curve shown, which of the following is true?

a. Tax revenue would increase if marginal tax rates were lowered from point C.

b. Tax revenue would decrease if marginal tax rates were lowered from point A.

c. Tax revenues are maximized at a tax rate corresponding to point B.

d. All of the above are true.

In Operation Desert Storm, oil facilities in Iraq were attacked amid strong demand for oil. In response, political pressure motivated OPEC to increase the daily quota by 2 million barrels a day. Assuming demand did not change, which of the following series of prices most likely matches how the price of a barrel of oil changed from (1) before the attack, to (2) just after the attack, to (3) after OPEC increased the quota?

A. $40, $42, $38 B. $42, $38, $40 C. $38, $40, $42 D. $42, $40, $38