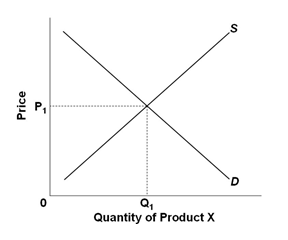

Refer to the supply and demand graph of Product X below. What would happen if the government taxed the producers of this product because it has negative externalities in production?

A. Supply would increase

B. Demand would decrease

C. Supply would decrease

D. Price would increase

C. Supply would decrease

You might also like to view...

The best argument against monetarists' arguments that steady money growth would prevent fluctuations in inflation and unemployment is that:

a. the government has best control over fiscal policy and should focus on that. b. large fluctuations in the money supply cannot occur because the supply of money is limited. c. steady money growth does not necessarily mean steady aggregate demand if velocity is not stable. d. steady growth in the money supply percents fluctuations in output only if aggregate prices are constant.

Suppose that the market for steel is shown in the above figure. Is social welfare greater under monopoly or under competition?

What will be an ideal response?

A public museum is an example of a

A) government-sponsored good. B) public good. C) good which generates a positive externality. D) good which generates a negative externality.

If you believe that a worker should be paid on the basis of what he or she produced, you believe in

A) the egalitarian principle. B) the productivity standard. C) the benefits standard. D) the comparative worth principle.