If the purchasing power of a dollar is less than the purchasing power of the euro, purchasing power parity would predict that

A) in the long run, interest rates will move to equalize the purchasing power of the dollar and the euro.

B) in the short run, interest rates will move to equalize the purchasing power of the dollar and the euro.

C) in the short run, exchange rates will move to equalize the purchasing power of the dollar and the euro.

D) in the long run, exchange rates will move to equalize the purchasing power of the dollar and the euro.

D

You might also like to view...

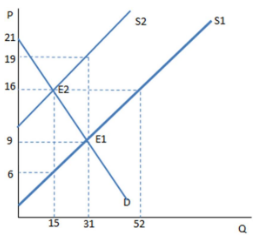

Consider the graph shown. What would most likely be the cause of a shift from S1 to S2?

A. A tax on sellers

B. A tax on buyers

C. A subsidy for sellers

D. A subsidy for buyers

Which of the following is true? a. When real interest rates are higher in country A than country B there will tend to be a capital flow from country B to country A. b. When real interest rates are higher in country A than country B there will tend to be a capital flow from country A to country B. c. Capital flows will tend to increase real interest rates in countries with a capital inflow

d. Both b. and c. are correct.

Australia is a net exporter of wool, free trade will benefit the ________.

A. domestic consumers B. poor citizens of the Australia C. domestic producers D. rich citizens of the Australia

If the own-price elasticity of demand is -1.25, in order for the manufacturer of Ragu to increase total revenue, at least in the short run, it would be advisable to

A) Can't tell; insufficient information B) Raise the price of Ragu. C) Lower the price of Ragu. D) Do nothing.