Assume that the required reserve ratio for the commercial banks is 25 percent. If the Federal Reserve Banks buy $3 billion in government securities from the non-bank securities dealers, then as a result of this transaction, the lending ability of the commercial banking system will increase by:

A. $4.5 billion

B. $9 billion

C. $12 billion

D. $15 billion

B. $9 billion

Economics

You might also like to view...

What is a long-run supply curve? What does a long-run supply curve look like on a perfectly competitive market graph?

What will be an ideal response?

Economics

Classical economists think that the government ________ use fiscal policy to dampen the business cycle because prices and wages adjust ________

A) should not; rapidly B) should not; slowly C) should; slowly D) should; rapidly

Economics

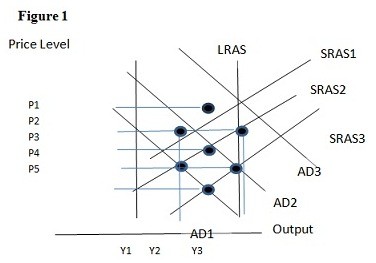

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

Economics

Monopolistic competition and oligopoly are alike because firms in both market structures have some market power.

a. true b. false

Economics