If an excise tax reduces economic surplus why does the government impose the tax?

A. The marginal benefits of programs funded by the tax is worth the marginal cost.

B. The opportunity cost of having the tax is higher.

C. Tax revenue is scarce and the government needs to tax the right goods.

D. The government needs the money to get out of debt.

Answer: A

You might also like to view...

The income elasticity of demand for foreign travel

A) is likely to be smaller than the income elasticity of demand for food. B) is likely to be larger than the income elasticity of demand for food. C) cannot be compared to the income elasticity of demand for food. D) is likely to be inelastic. E) is likely to be negative.

Advertising by firms in monopolistic competition

A) provides consumers with no useful information. B) does not occur. C) can persuade customers that product differentiation exists. D) wastes resources because the entry of rivals forces firms to be price takers.

Full employment in the classical model is maintained by

A) flexible interest rates. B) flexible wage rates. C) flexible prices. D) flexible income.

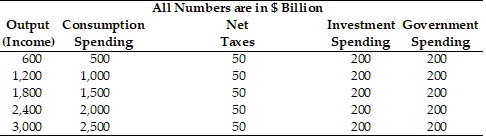

Refer to the information provided in Table 24.3 below to answer the question(s) that follow.

Table 24.3 Refer to Table 24.3. At an output level of $1,200 billion, the level of aggregate expenditure is

Refer to Table 24.3. At an output level of $1,200 billion, the level of aggregate expenditure is

A. $1,100 billion. B. $1,250 billion. C. $1,400 billion. D. $1,450 billion.