Why do some policymakers support a consumption tax rather than an earnings tax?

a. The average tax rate would be lower under a consumption tax.

b. A consumption tax would encourage people to save earned income.

c. A consumption tax would raise more revenues than an income tax.

d. The marginal tax rate would be higher under an earnings tax.

b

You might also like to view...

If the base year CPI market basket costs $250 and next year the CPI market basket costs $275, what is next year's CPI?

What will be an ideal response?

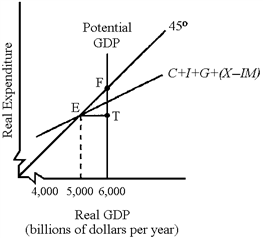

Figure 11-1

?

A. increase taxes. B. decrease transfer payments. C. increase government purchases. D. None of the above is correct.

A technological change in the production of cars will

A. have no effect on consumers. B. affect input and output markets in the automobile industry and other related industries. C. affect only the markets for inputs used to produce cars. D. affect only the way cars are produced.

A movement up the aggregate supply curve is caused by a(n)

A. decrease in the price level. B. increase in aggregate supply. C. increase in the price level. D. decrease in aggregate supply.