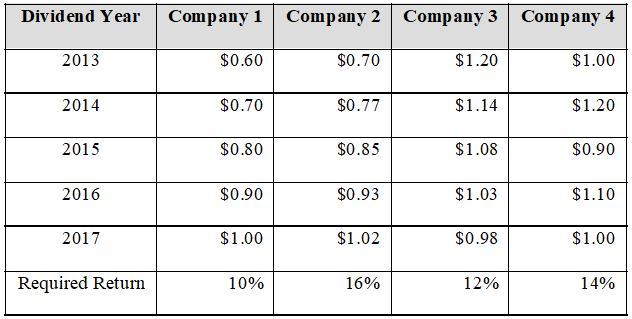

Historical dividends for four companies are given in the following table:

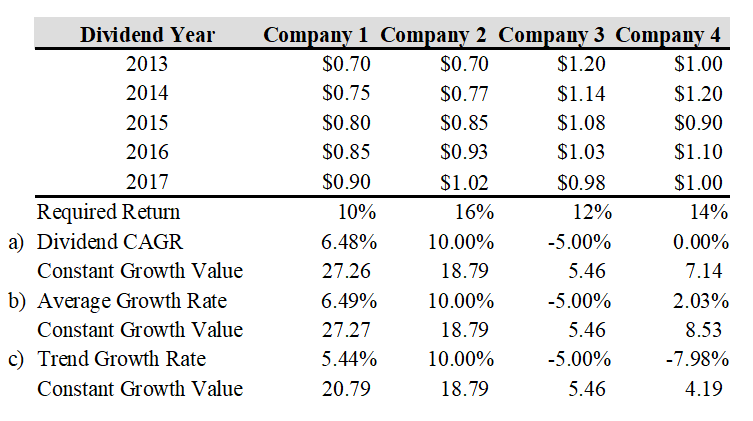

a) Calculate the compound average annual growth rate of the dividend for each company. If you expect the dividend to grow at that rate in the future, what is the price at which you would be willing to buy these companies’ stocks?

b) Calculate the arithmetic average annual growth rate of the dividend for each company. If you expect the dividend to grow at that rate in the future, what is the price at which you would be willing to buy these companies’ stocks?

c) Use the TREND function to calculate the dividend growth rate of each company. If you expect the dividend to grow at that rate in the future, what is the price at which you would be willing to buy these companies’ stocks?

You might also like to view...

What is seignorage revenue and how does it apply to U.S. coins?

What will be an ideal response?

Devon is in the market for a new car. She is seriously considering either a Honda Civic or Toyota Corolla because they both have excellent quality and safety ratings and are comparable in price

Devon is in the ________ stage of the buyer decision process. A) evaluation of alternatives B) need recognition C) information search D) purchase decision E) postpurchase behavior

Mobile ads rarely create substantial customer engagement and impact

Indicate whether the statement is true or false

Accounts receivable arising from sales to customers amounted to $40,000 and $31,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $120,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is

A) $120,000. B) $129,000. C) $151,000. D) $111,000.