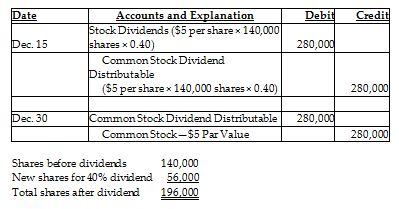

Sherry, Inc. had 140,000 shares of $5 par value common stock issued and outstanding as of December 15, 2018. The company is authorized to issue 1,000,000 common shares. On December 15, 2018, Sherry declared a 40% stock dividend when the market value for its common stock was $9 per share. The stock was issued on Dec. 30.

Prepare the journal entries to record the declaration and distribution of the stock dividend. Explanations are not required. Compute the total shares after the dividend.

You might also like to view...

Cox Merchandising Company began the year with merchandise inventory of $60,000, ended the year with merchandise inventory of $70,000, and had cost of goods sold of $110,000 . What was the Cox Merchandising Company's net purchases for the year?

a. $100,000 b. $110,000 c. $120,000 d. $130,000 e. none of the above

Pluto accuses Quark, an accountant, of committing defalcation. This is

A. embezzlement. B. general misconduct. C. professional negligence. D. throwing something out of a window.

A company paid Jen Rogers, its sole stockholder, a total of $35,000 in dividends during the current year. The entry needed to close the dividends account is:

A. Debit Income Summary and credit Cash for $35,000. B. Debit Dividends and credit Retained earnings for $35,000. C. Debit Dividends and credit Cash for $35,000. D. Debit Income Summary and credit Dividends for $35,000. E. Debit Retained earnings and credit Dividends for $35,000.

Discretionary financing needed must be obtained through additional borrowing because additional

equity measured by the increase in retained earnings has already been deducted. Indicate whether the statement is true or false