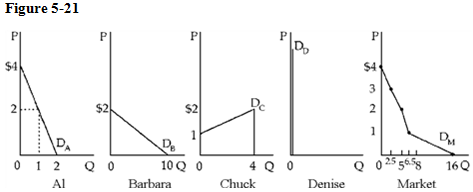

Draw individual demands for caviar for Al, Barbara, Chuck, and Denise where Al’s demand is relatively inelastic, Barbara’s is elastic, Chuck’s is upward sloping, and Denise refuses to eat caviar at any price. Then draw the corresponding market demand.

What will be an ideal response?

(See Figure 5-21). Al’s demand is steep with respect to price, while Barbara’s is relatively flat. Chuck’s D slopes up with respect to price, while Denise consumes zero at all prices. Market demand is a horizontal summation of individual demands at quantities purchased by A, B, and C (D is zero). Market D will slope down unless Chuck has such a strong opposite relationship to offset the downward demands of both Al and Barbara.

You might also like to view...

Which of the following is NOT true about the $3 per pizza tax illustrated in the above figure?

A) It decreases consumer surplus by $90 thousand. B) It decreases producer surplus by $45 thousand. C) It creates a deadweight loss of $135 thousand. D) None of the above because they are all true.

A person who agrees to buy an asset at a future date is going

A) long. B) short. C) back. D) ahead.

Which of the following is not a criticism of the national defense argument for trade restrictions?

a. National defense only makes sense in the absence of international trade. b. Stockpiling basic military hardware could eliminate the need to protect the domestic industry. c. Nearly all industries can make some claim to strategic importance, so such trade restrictions can get out of hand. d. National defense considerations can outweigh concerns about efficiency. e. Government subsidies to domestic producers may be more efficient than trade restrictions.

The United States has a more equal income distribution than many developing economies such as Mexico, South Africa, and Brazil

a. True b. False Indicate whether the statement is true or false