If your income is $50,000 . your income tax liability is $10,000 . and you paid $0.25 in taxes on the last dollar you earned, your

a. marginal tax rate is 20 percent.

b. average tax rate is 5 percent.

c. marginal tax rate is 25 percent.

d. average tax rate is 25 percent.

c

You might also like to view...

In general, large current account deficits have to be financed by:

A) capital outflows abroad. B) capital inflows from abroad. C) trade barriers. D) none of the above.

Pension fund growth has been spurred by the recent development of "defined __________ plans," such as the __________ plan

A) benefit; 401(k) B) benefit; Keogh C) contribution; 401(k) D) contribution; Keogh

Which of the following professionals is likely to receive higher compensatory wages?

a. Financial accountants b. Software engineers c. Sales workers d. Share traders e. Tailors

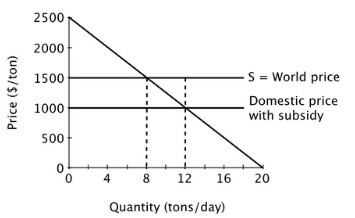

Suppose a small island nation imports sugar for its population at the world price of $1,500 per ton. The domestic market for sugar is shown below. With no subsidy, what is consumer surplus?

With no subsidy, what is consumer surplus?

A. $1,000 per day B. $9,000 per day C. $4,000 per day D. $8,000 per day