A machine produces no benefits now, but $200 in benefits at the end of a year. At the end of the year it falls apart into a heap of dust never to be used again. The present value of its income stream is approximately

A. $200 if the interest rate is 20%.

B. $220 if the interest rate is 10%.

C. $200 no matter what the interest rate is.

D. $182 if the interest rate is 10%.

Answer: D

You might also like to view...

Which of the following is most likely to increase an individual's future spending?

A) Paying back a loan in the future B) Borrowing money today C) Depositing money in the future D) Withdrawing money in the future

The problem of scarce resources

a. means that in some cities there are not enough jobs b. could be solved if the unemployment rate fell c. is that there are not enough resources to satisfy people's unlimited wants d. is that resources are used inefficiently e. can be solved by lowering taxes

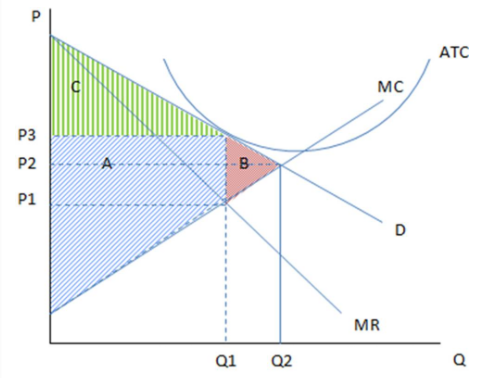

Assuming the firm in the graph is producing Q1 and charging P3, it is likely:

These are the cost and revenue curves associated with a firm.

A. in long-run equilibrium.

B. an efficient outcome.

C. not maximizing profits.

D. operating at a loss.

Economists refer to the inputs that firms use to produce goods and services as

a. derived factors. b. derived resources. c. factors of production. d. instruments of revenue.